Essay

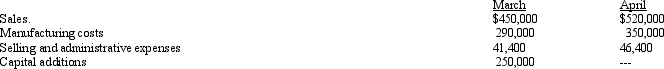

The treasurer of Systems Company has accumulated the following budget information for the first two months of the coming year:

The company expects to sell about 35% of its merchandise for cash. Of sales on account, 80% are expected to be collected in full in the month of the sale and the remainder in the month following the sale. One-fourth of the manufacturing costs are expected to be paid in the month in which they are incurred and the other three-fourths in the following month. Depreciation, insurance, and property taxes represent $6,400 of the probable monthly selling and administrative expenses. Insurance is paid in February and a $40,000 installment on income taxes is expected to be paid in April. Of the remainder of the selling and administrative expenses, one-half are expected to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are expected to be paid in March.

The company expects to sell about 35% of its merchandise for cash. Of sales on account, 80% are expected to be collected in full in the month of the sale and the remainder in the month following the sale. One-fourth of the manufacturing costs are expected to be paid in the month in which they are incurred and the other three-fourths in the following month. Depreciation, insurance, and property taxes represent $6,400 of the probable monthly selling and administrative expenses. Insurance is paid in February and a $40,000 installment on income taxes is expected to be paid in April. Of the remainder of the selling and administrative expenses, one-half are expected to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are expected to be paid in March.

Current assets as of March 1 are composed of cash of $45,000 and accounts receivable of $51,000. Current liabilities as of March 1 are composed of accounts payable of $121,500 ($102,000 for materials purchases and $19,500 for operating expenses). Management desires to maintain a minimum cash balance of $20,000.

Prepare a monthly cash budget for March and April.

Correct Answer:

Verified

_TB2013_00 *$450,000 × .35 = $...

_TB2013_00 *$450,000 × .35 = $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q135: A budget procedure that provides for the

Q136: Production estimates for August are as follows:

Q137: Once a static budget has been determined,

Q138: Supervisor salaries, maintenance, and indirect factory wages

Q139: If Division Inc. expects to sell 200,000

Q141: For January, sales revenue is $700,000; sales

Q142: Fashion Jeans, Inc. sells two lines of

Q143: A formal written statement of management's plans

Q144: A company is preparing its their Cash

Q145: The budgetary unit of an organization which