Essay

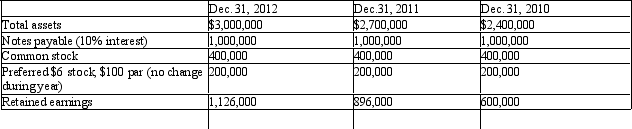

The following selected data were taken from the financial statements of the Berrol Group for December 31, 2012, 2011, and 2010:

The 2012 net income was $242,000 and the 2011 net income was $308,000. No dividends on common stock were declared between 2010 and 2012.

The 2012 net income was $242,000 and the 2011 net income was $308,000. No dividends on common stock were declared between 2010 and 2012.

Required:

(1) Determine the rate earned on total assets, the rate earned on stockholders' equity, and the rate earned on common stockholders' equity for the years 2012 and 2011. Round to one decimal place.

(2) What conclusion can be drawn from these data as to the company's profitability?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: An advantage of the current ratio is

Q54: The following items are reported on a

Q55: In computing the rate earned on total

Q56: Selected data from the Carmen Company at

Q57: When you are interpreting financial ratios, it

Q59: A company reports the following:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2013/.jpg"

Q61: The numerator of the rate earned on

Q63: The following items were taken from the

Q92: A 15% change in sales will result

Q174: The report on internal control required by