Essay

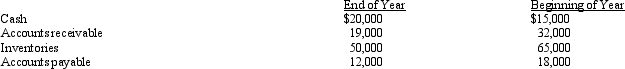

The Dickinson Company reported net income of $155,000 for the current year. Depreciation recorded on buildings and equipment amounted to $65,000 for the year. In addition, a building with an original cost of $250,000 and accumulated depreciation of $190,000 on the date of the sale, was sold for $75,000. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows:

Instructions

Instructions

Prepare the cash flows from the operating activities section of the statement of cash flows using the indirect method.

Correct Answer:

Verified

Correct Answer:

Verified

Q48: Cash outflows from financing activities include the

Q99: Which of the following represents an inflow

Q102: Cash flow per share is<br>A) required to

Q135: The declaration and issuance of a stock

Q147: Income tax was $175,000 for the year.

Q150: Cost of merchandise sold reported on the

Q151: Master Designs Company has cash flows for

Q154: Which of the following concepts of cash

Q156: Cash receipts received from the issuance of

Q157: The net income reported on the income