Multiple Choice

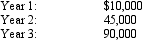

Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:  Determine the dividends in arrears for preferred stock for the second year.

Determine the dividends in arrears for preferred stock for the second year.

A) $25,000

B) $10,000

C) $0

D) $30,000

Correct Answer:

Verified

Correct Answer:

Verified

Q33: A disadvantage of the corporate form of

Q36: The charter of a corporation provides for

Q38: A stock split results in a transfer

Q59: Prepare entries to record the following:<br> <img

Q60: Merritt Company acquired a building valued at

Q62: Under the corporate form of business organization<br>A)

Q65: If common stock is issued for an

Q67: Sabas Company has 20,000 shares of $100

Q69: Treasury stock which was purchased for $3,000

Q115: The amount of capital paid in by