Multiple Choice

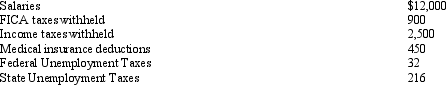

Use the following information to answer the following questions. The following totals for the month of April were taken from the payroll register of Magnum Company. The entry to record accrual of employer's payroll taxes would include a

The entry to record accrual of employer's payroll taxes would include a

A) debit to Payroll Tax Expense for $248

B) debit to FICA Taxes Payable for $1,800

C) credit to Payroll Tax Expense for $248

D) debit to Payroll Tax Expense for $1,148

Correct Answer:

Verified

Correct Answer:

Verified

Q59: FICA tax becomes a liability to the

Q113: The journal entry a company uses to

Q115: The following totals for the month of

Q116: Journalize the following transactions for Riley Corporation:<br>

Q118: The payroll register is a multicolumn form

Q119: A business borrowed $40,000 on March 1

Q121: Research Company sells merchandise with a one

Q122: Federal unemployment compensation tax becomes an employer's

Q122: Journalize the following, assuming a 360-day year

Q131: All long-term liabilities eventually become current liabilities.