Multiple Choice

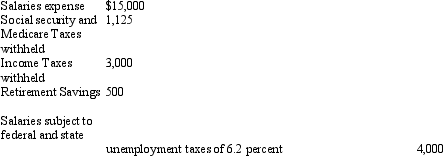

The following totals for the month of June were taken from the payroll register of Young Company:  The entry to record the accrual of employer's payroll taxes would include a

The entry to record the accrual of employer's payroll taxes would include a

A) debit to Payroll Taxes Expense for $2,498

B) debit to Social Security and Medicare Tax Payable for $2,250

C) debit to Payroll Taxes Expense for $1,373

D) Debit to Payroll Tax Expense for $1,125

Correct Answer:

Verified

Correct Answer:

Verified

Q65: Proper payroll accounting methods are important for

Q67: An employee receives an hourly rate of

Q68: Estimating and recording product warranty expense in

Q70: An aid in internal control over payrolls

Q71: According to a summary of the payroll

Q73: Garrett Company sells merchandise with a one

Q74: The journal entry a company uses to

Q164: The cost of a product warranty should

Q183: Chang Co. issued a $50,000, 120-day, discounted

Q196: Payroll taxes only include social security taxes