Multiple Choice

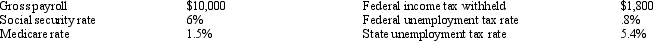

Use the following information to answer the following questions. Assuming no employees are subject to ceilings for their earnings, Jensen Company has the following information for the pay period of January 15 - 31, 20xx. Assuming that all wages are subject to federal and state unemployment taxes, the Payroll Taxes Expense would be recorded as:

Assuming that all wages are subject to federal and state unemployment taxes, the Payroll Taxes Expense would be recorded as:

A) $1,370

B) $750

C) $620

D) $2,870

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Use the following information to answer the

Q10: A pension plan which requires the employer

Q11: The journal entry a company uses to

Q16: Florida Keys Construction installs swimming pools. They

Q17: Interest expense is reported in the operating

Q18: Obligations that depend on past events and

Q19: Like many taxes deducted from employee earnings,

Q120: For proper matching of revenues and expenses,

Q185: Form W-4 is a form authorizing employers

Q192: The proceeds from discounting a $20,000, 60-day