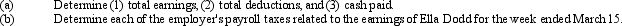

Essay

The following information is for employee Ella Dodd for the week ended March 15.

Total hours worked: 48

Rate: $15 per hour, with double time for all hours in excess of 40

Federal income tax withheld: $200

United Fund deduction: $50

Cumulative earnings prior to current week: $6,400

Tax rates:

Social security: 6% on maximum earnings of $100,000. Medicare tax:

1.5% on all earnings.

State unemployment: 3.4% on maximum earnings of $7,000; on employer

Federal unemployment: 0.8% on maximum earnings of $7,000; on employer

Correct Answer:

Verified

(a)

_TB20...

_TB20...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: A defined contribution plan promises employees a

Q83: Each year, there is a ceiling for

Q142: The use of a separate payroll bank

Q149: Vacation pay payable is reported on the

Q152: Which of the following are included in

Q154: For an interest bearing note payable, the

Q155: Which of the following would most likely

Q156: The journal entry a company uses to

Q169: Which of the following would be used

Q175: FICA tax is a payroll tax that