Essay

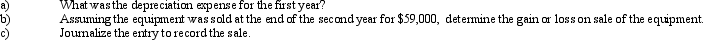

Equipment was acquired at the beginning of the year at a cost of $75,000. The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,500.

Correct Answer:

Verified

a) $11,250...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Intangible assets differ from property, plant, and

Q44: The calculation for annual depreciation using the

Q46: The Bacon Company acquired new machinery with

Q47: Xtra Company purchased goodwill from Argus for

Q48: Eagle Country Club has acquired a lot

Q51: On June 1, 2014, Aaron Company purchased

Q52: Which of the following is included in

Q74: A new machine with a purchase price

Q137: The term applied to the amount of

Q180: Though a piece of equipment is still