Essay

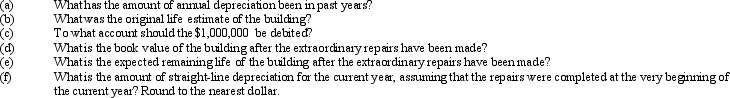

A number of major structural repairs completed at the beginning of the current fiscal year at a cost of $1,000,000 are expected to extend the life of a building 10 years beyond the original estimate. The original cost of the building was $6,552,000, and it has been depreciated by the straight-line method for 25 years. Estimated residual value is negligible and has been ignored. The related accumulated depreciation account after the depreciation adjustment at the end of the preceding fiscal year is $4,550,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q79: When selling a piece of equipment for

Q132: Revising depreciation estimates does affect the amounts

Q133: Prepare the following journal entries and calculations:<br>

Q134: When a company discards machinery that is

Q135: Capital expenditures are costs that are charged

Q136: When a company exchanges machinery and receives

Q139: Golden Sales has bought $135,000 in fixed

Q140: An estimate of the amount which an

Q142: For income tax purposes most companies use

Q215: Functional depreciation occurs when a fixed asset