Related Questions

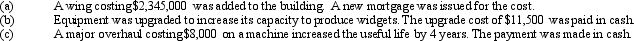

Q31: The acquisition costs of property, plant, and

Q100: Long-lived assets held for sale are classified

Q101: When old equipment is traded in for

Q158: A copy machine acquired on March 1,

Q159: A machine costing $57,000 with a 6-year

Q164: All of the following below are needed

Q165: The amount of depreciation expense for the

Q166: On December 31, Strike Company has decided

Q167: Factors contributing to a decline in the

Q198: Comment on the validity of the following