Essay

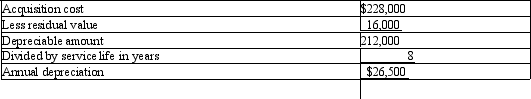

On July 1st, Harding Construction purchases a bulldozer for $228,000. The equipment has a 8 year life with a residual value of $16,000. Harding uses straight-line depreciation.

(a) Calculate the depreciation expense and provide the journal entry for the first year ending December 31st.

(b) Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31st.

(c) Calculate the last year's depreciation expense and provide the journal entry for the last year.

Annual depreciation is:

Correct Answer:

Verified

(a) First year depreciation is $26,500 ×...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q73: Both the initial cost of the asset

Q79: When selling a piece of equipment for

Q140: An estimate of the amount which an

Q142: For income tax purposes most companies use

Q144: The exclusive right to use a certain

Q146: A machine with a cost of $120,000

Q147: Computer equipment was acquired at the beginning

Q150: Computer equipment was acquired at the beginning

Q183: The cost of new equipment is called

Q194: An exchange is said to have commercial