Multiple Choice

Use the following to answer questions

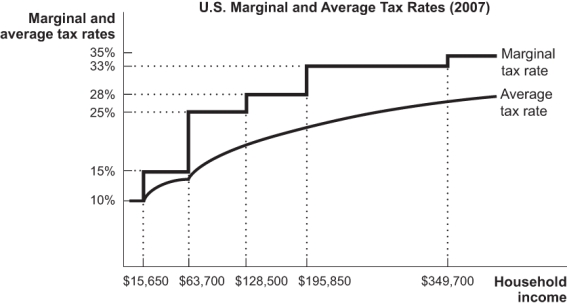

Figure: U.S.Marginal and Average Tax Rates

-(Figure: U.S.Marginal and Average Tax Rates) According to the tax rates shown in the figure,an individual who earns $63,700 a year,has no deductions,and claims no exemptions will pay income tax of:

A) $8,772.50.

B) $9,555.00.

C) $15,925.00.

D) $1,565.00.

Correct Answer:

Verified

Correct Answer:

Verified

Q115: The AMT has significantly increased the tax

Q116: Use the following to answer questions <br>Figure:

Q117: Is the marginal income tax rate or

Q118: Explain the difference between Medicare and Medicaid.

Q119: The original purpose of the alternative minimum

Q121: What is the expected future trend of

Q122: The current U.S.debt-to-GDP ratio is the highest

Q123: Which of the following represents a change

Q124: The Social Security payment system began issuing

Q125: Most of the spending in the federal