Multiple Choice

Use the following to answer questions

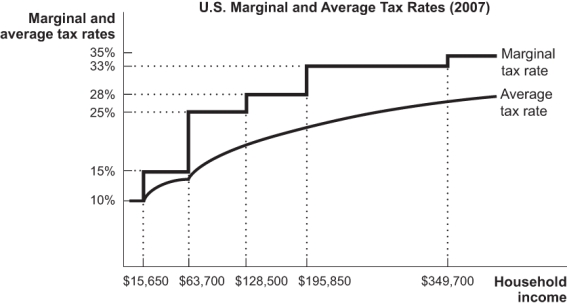

Figure: U.S.Marginal and Average Tax Rates

-(Figure: U.S.Marginal and Average Tax Rates) According to the tax rates shown in the figure,an individual who earns $150,000 a year has an approximate average tax rate of:

A) 28%.

B) 25%.

C) 20%.

D) 15%.

Correct Answer:

Verified

Correct Answer:

Verified

Q100: The second-largest source of revenue for the

Q101: The U.S.income tax system is:<br>A) proportional.<br>B) progressive.<br>C)

Q102: Current projections are that the debt-to-GDP ratio

Q103: What are the three largest sources of

Q104: The deficit is all federal debt held

Q106: The marginal tax rate is:<br>A) the tax

Q107: If tax rates are 10% on income

Q108: As income rises,the average tax rate for

Q109: Which tax rate determines whether it is

Q110: Currently,marginal tax rates are:<br>A) greater than in