Multiple Choice

Use the following to answer questions

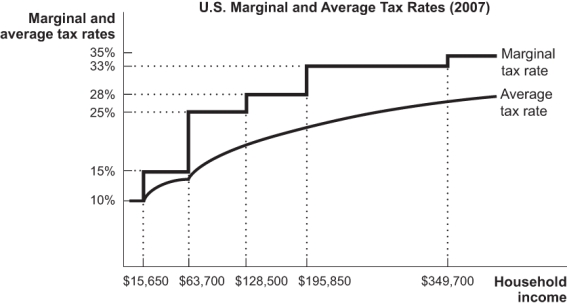

Figure: U.S.Marginal and Average Tax Rates

-(Figure: U.S.Marginal and Average Tax Rates) Using the tax rates shown in the figure,assume your annual income is $15,000,that you have a deduction of $1,800 for moving expenses,and that you claim four exemptions of $3,300: one for yourself and one for each of your three children.How much taxes are you expected to pay?

A) $0

B) $120

C) $132

D) $138

Correct Answer:

Verified

Correct Answer:

Verified

Q10: A country has two income tax brackets:

Q11: Corporate income taxes bring in as much

Q12: The Federal Insurance Contributions Act tax is

Q13: In recent decades,health-care costs per capita rose

Q14: Suppose a high-income individual,subject to a 15%

Q16: What kind of rising costs will mostly

Q17: If the U.S.government decides to decrease the

Q18: The marginal tax rate is the:<br>A) average

Q20: Since the mid-1950s,federal government spending has been

Q107: The corporate income tax is the single