Multiple Choice

Use the following to answer questions :

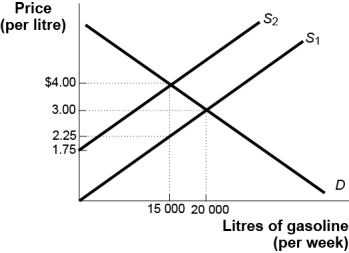

Figure: The Gasoline Market

-(Figure: The Gasoline Market) Use Figure: The Gasoline Market.The pre-tax equilibrium price is $3,and the equilibrium quantity before tax is 20 000 litres.An excise tax has been levied on each litre of gasoline supplied by producers,shifting the supply curve upward.The total tax revenue collected by the government is equal to:

A) $1.50.

B) $15 000.

C) $26 250.

D) $30 000.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: A lump-sum tax,such as the fee for

Q3: Eli has annual earnings of $100,000 and

Q11: Suppose that Justin Trudeau initiates a revision

Q57: If the government imposes a $5 excise

Q96: Determining who actually pays the cost imposed

Q108: If the government wants to limit sales

Q155: Use the following to answer question: <img

Q251: If the government levies an excise tax

Q256: If demand is perfectly inelastic,the deadweight loss

Q285: Use the following to answer question: <img