Essay

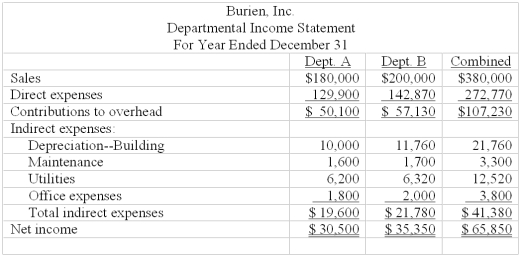

Burien, Inc. operates a retail store with two departments, A andB. Its departmental income statement for the current year follows:

Burien allocates building depreciation, maintenance, and utilities on the basis of square footage. Office expenses are allocated on the basis of sales.

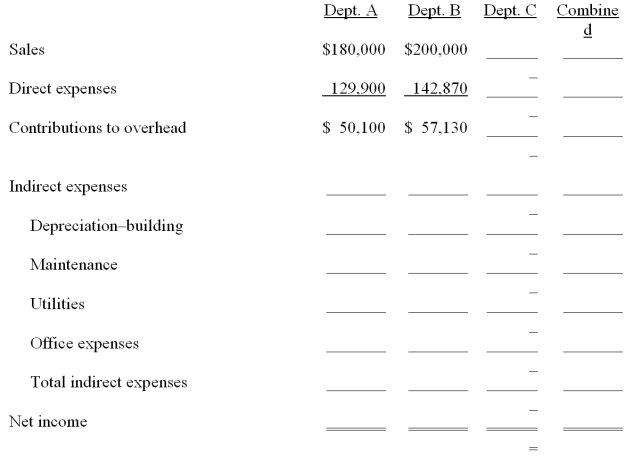

Management is considering an expansion to a three-department operation. The proposed Department C would generate $120,000 in additional sales and have a 17.5% contribution to overhead. The company owns its building. Opening Department C would redistribute the square footage to each department as follows: A, 19,040; B, 21,760 sq. ft.; C, 13,600. Increases in indirect expenses would include: maintenance, $500; utilities, $3,800; and office expenses, $1,200.

Complete the following departmental income statements, showing projected results of operations for the three sales departments. (Round amounts to the nearest whole dollar.)

Correct Answer:

Verified

* $3,300 + $500 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

* $3,300 + $500 ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Ice House Industries, Inc. has

Q8: Renton Co. has two operating (production) departments

Q10: The following data are available for

Q11: Which of the following is an example

Q41: What is the main difference between a

Q124: Controllable costs are the same as direct

Q169: An accounting system that provides information that

Q171: An accounting system that provides information that

Q177: A _ incurs costs without directly generating

Q180: A joint cost of producing two products