Essay

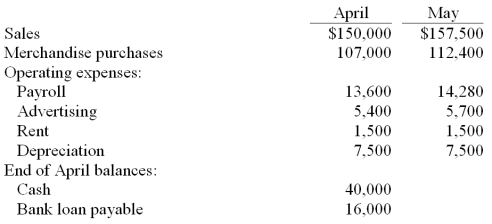

Sweeny Co. is preparing a cash budget for the second quarter of the coming year. The following data have been forecasted:

Additional data:

(1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and the balance paid in the following month.

(3) Operating expenses are paid in the month they are incurred.

(4) A minimum cash balance of $40,000 is required at the end of each month.

(5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made whenever excess cash is available.

Prepare the company's cash budget for May. Show the ending loan balance at May 31.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A manufacturing budget should include a list

Q8: The master budget process usually ends with:<br>A)

Q13: A company's gross profit rate is 30%

Q21: If budgeted beginning inventory is $8,300, budgeted

Q35: Bentels Co. desires a December 31 ending

Q36: Reference: 20_04<br>Kyoto, Inc. predicts the following

Q64: The Lamb Company budgeted sales for January,

Q99: Tannwin Co. sells a new product

Q100: Use the following data to determine the

Q111: Why is the sales budget usually prepared