Essay

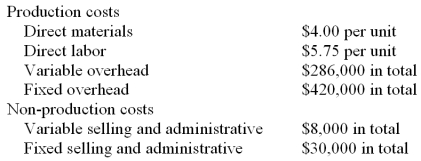

Peapod Company, a manufacturer of slippers, began operations on May 1 of the current year. During this time, the company produced 200,000 units and sold 180,000 units at a sales price of $36 per unit. Cost information for this period is shown below.

(a.) Prepare Peapod's December 31st income statement for the current year under absorption costing.

(b.) Prepare Peapod's December 31st income statement for the current year under variable costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Heather, Incorporated reports the following annual cost

Q25: Sea Company reports the following information

Q30: Assume that the following information was

Q35: On a contribution margin income statement,expenses are

Q37: Fanelli Company had net income of $678,000

Q93: Fomtech,Inc.had net income of $750,000 based on

Q100: Under a traditional income statement format expenses

Q144: _ is the amount remaining from sales

Q165: Toth,Inc.had net income of $950,000 based on

Q193: Under variable costing,the product unit cost consists