Essay

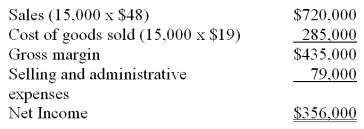

Anchovy, Inc., a producer of frozen pizzas, began operations this year. During this year, the company produced 16,000 cases of pizza and sold 15,000. At year-end, the company reported the following income statement using absorption costing.

Production costs per case total $19, which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced). Eight percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Correct Answer:

Verified

$356,000 -...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Which of the following is not a

Q31: How does contribution margin differ from gross

Q31: Managers should accept special orders provided the

Q46: How will net income under variable costing

Q64: Planet Corporation sold 21,000 units of its

Q75: Branwin Corporation sold 7,200 units of its

Q120: Variable costing is the only acceptable basis

Q143: Which of the following statements is true?<br>A)

Q147: Assume that the following information was

Q155: Gage Company reports the following information