Essay

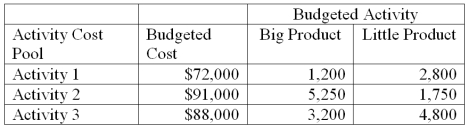

A company has two products: Big and Little. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools.

Annual production and sales level of big product is 62,525 units, and the annual production and sales level of little product is 251,900 units.

(a.) Compute the approximate overhead cost per unit of big product under activity-based costing.

(b.) Compute the approximate overhead cost per unit of little product under activity-based costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: The final step of activity-based costing assigns

Q40: Time Bender Company makes watches and clocks.

Q68: The major advantages of using a single

Q80: Activity-based costing first assigns costs to products

Q137: Because departmental overhead costs are allocated based

Q161: A cost pool is a collection of

Q179: Why is overhead allocation under ABC usually

Q194: When using the plantwide overhead rate method,total

Q200: Activity-based costing eliminates the need for overhead

Q210: The more activities tracked by activity-based costing,the