Essay

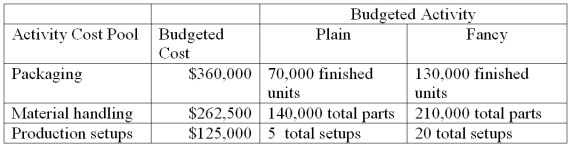

Sparks Company produces and distributes two types of garden sculptures, Plain and Fancy. Budgeted cost and activity for each of its three activity cost pools are shown below. The company plans to produce and sell 64,000 plain units and 49,150 fancy units.

(a.) Compute the approximate overhead cost per unit of Plain under activity-based costing.

(b.) Compute the approximate overhead cost per unit of Fancy under activity-based costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Machine setup costs are an example of

Q5: Which of the following is not true?<br>A)

Q14: By definition,costs classified as overhead are consumed

Q115: A company allocates $7.50 overhead to

Q118: Inside Out, Company designs custom showroom spaces

Q121: Overhead costs are often affected by many

Q122: A company produces paint which goes

Q134: The departmental overhead rate method uses a

Q172: Batch-level costs vary with the number of

Q184: Activity-based costing involves four steps: (1)identify activities