Multiple Choice

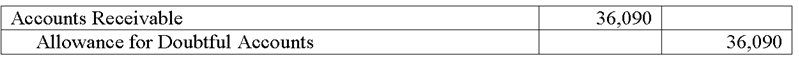

A company ages its accounts receivables to determine its end of period adjustment for bad debts. At the end of the current year, management estimated that $39,375 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a credit balance of $3,285. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q91: A dishonored note receivable is usually reclassified

Q122: The _ method uses income statement relationships

Q143: A company borrowed $5,000 by signing a

Q145: Wallah Company agreed to accept $5,000

Q149: A company used the percent of

Q150: The amount due on the date of

Q150: A company has sales of $350,000 and

Q162: Pepsi's accounts receivable turnover was 9.9 for

Q171: A payee of a note will always

Q192: As long as a company accurately records