Multiple Choice

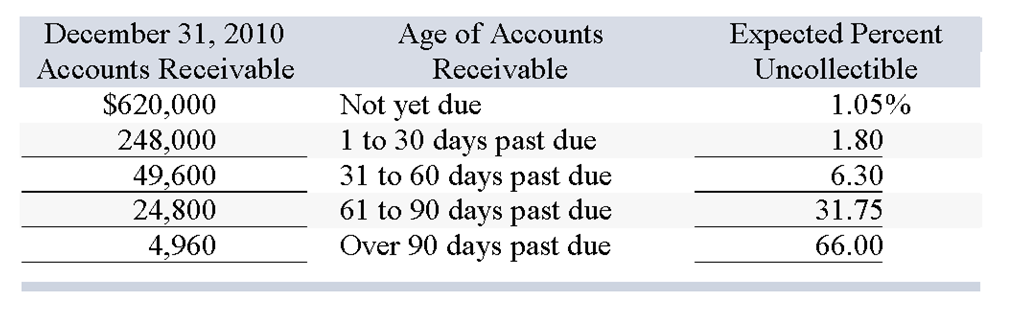

Temper Company has credit sales of $3.10 million for year 2010. Temper estimates that 2% of accounts receivable will remain uncollectible. Historically, .9% of sales have been uncollectible. On December 31, 2010, the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $2,575. Temper prepares a schedule of its December 31, 2010, accounts receivable by age. Based on past experience, it estimates the percent of receivables in each age category that will become uncollectible. This information is summarized here:

Assuming the company uses the percent of accounts receivable method, what is the amount that Temper will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

A) $18,947.20

B) $16,372.20

C) $23,024.40

D) $27,900.00

E) $21,522.20

Correct Answer:

Verified

Correct Answer:

Verified

Q25: The percent of sales method for estimating

Q39: Describe how accounts receivable arise and how

Q61: The _ methods use balance sheet relationships

Q72: Welles Company uses the direct write-off method

Q76: Under the allowance method of accounting for

Q77: Chiller Company has credit sales of

Q107: Credit sales are recorded by crediting an

Q129: Receivables can be used to obtain cash

Q159: The aging method of determining bad debts

Q198: The quality of receivables refers to the