Multiple Choice

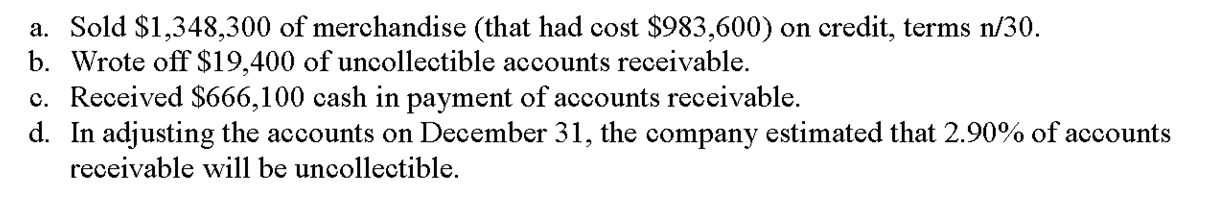

Vine Company began operations on January 1, 2010. During its first year, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows:

What is the amount required for the adjusting journal entry to record bad debt expense?

A) $18,644.90

B) $39,100.70

C) $19,783.80

D) $19,221.20

E) $19,400.20

Correct Answer:

Verified

Correct Answer:

Verified

Q92: The accounting principle that requires financial statements

Q96: The percent of sales method of estimating

Q112: Hasbro had net sales of $7,875 and

Q114: Cairo Co.uses the allowance method of accounting

Q128: Prepare general journal entries for the following

Q131: A company receives a 6.2%,60-day note for

Q147: The percent of accounts receivable method for

Q147: A credit sale of $2,500 to a

Q148: Writing off an uncollectible account receivable when

Q205: The_ method of accounting for bad debts