Essay

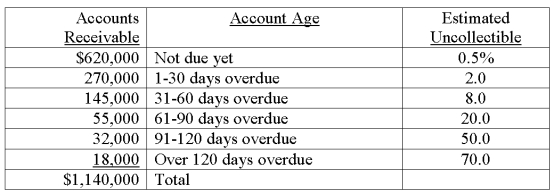

A company uses the aging of accounts receivable method to estimate its bad debts expense. On December 31 of the current year an aging analysis of accounts receivable revealed the following:

Required:

a. Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet

b. Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement, assuming that the balance of the Allowance for Doubtful Accounts on January 1 of the current year was $44,000 and that accounts receivable written off during the current year totaled $49,200

c. Prepare the adjusting journal entry to record bad debts expense on December 31 of the current year

d. Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Dell reported net sales of $8,739 million

Q15: A company reports the following results

Q20: The following information is from the

Q21: Teller purchased merchandise from TechCom on

Q109: A company factored $35,000 of its accounts

Q121: At December 31 of the current year,a

Q123: The person that borrows money and signs

Q127: What is the accounts receivable turnover ratio?

Q136: Explain the options a company has when

Q201: Sellers generally prefer to receive notes receivable