Short Answer

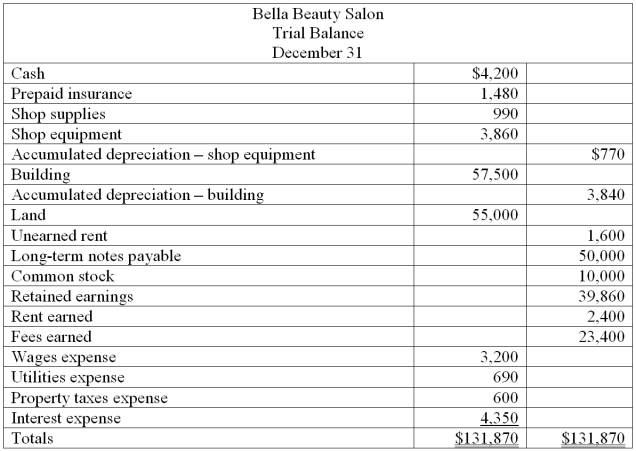

Based on the following information, prepare the adjusting journal entries for Bella's Beauty Salon. Bella Beauty Salon's unadjusted trial balance for the current year follows:

Additional information:

a. An insurance policy examination showed $1,240 of expired insurance

b. An inventory count showed $210 of unused shop supplies still available

c. Depreciation expense on shop equipment, $350

d. Depreciation expense on the building, $2,220

e. A beautician is behind on space rental payments and this $200 of accrued revenue was unrecorded at the time the trial balance was prepared.

f. $800 of the Unearned Rent account balance was earned by year-end.

g. The one employee, a receptionist, works a five-day workweek at $50 per day. The employee was paid last week but has worked four days this week for which she has not been paid.

h. Three months' property taxes, totaling $450, have accrued. This additional amount of property taxes expense has not been recorded.

i. One month's interest on the note payable, $600, has accrued but is unrecorded.

Correct Answer:

Verified

a.

b.

c.

d...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.

c.

d...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Prior to recording adjusting entries, the Office

Q30: IFRS tends to be more principles-based compared

Q32: What are the types of adjusting entries

Q37: Before an adjusting entry is made to

Q51: Interim statements report a company's business activities

Q91: In accrual accounting, accrued revenues are recorded

Q151: A company's ledger accounts and their

Q157: Calculate the current ratio in each

Q158: Under the alternative method for recording

Q275: A company had $7,000,000 in net income