Multiple Choice

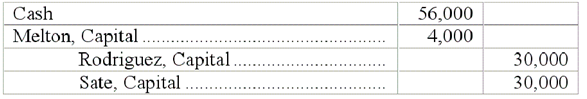

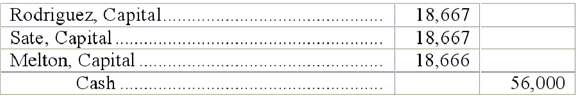

Rodriguez, Sate and Melton are dissolving their partnership. Their partnership agreement allocates income and losses equally among the partners. The current period's ending capital account balances are Rodriguez, $30,000, Sate, $30,000, Melton, $(4,000) . After all the assets are sold and liabilities are paid, but before any contributions are considered to cover any deficiencies, there is $56,000 in cash to be distributed. Melton pays $4,000 to cover the deficiency in her account. The general journal entry to record the final distribution would be:

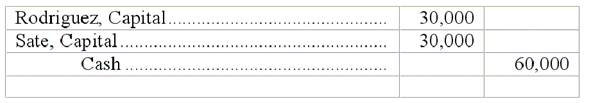

A)

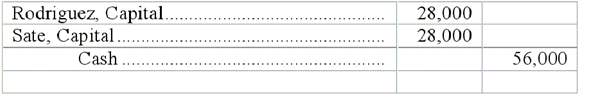

B)

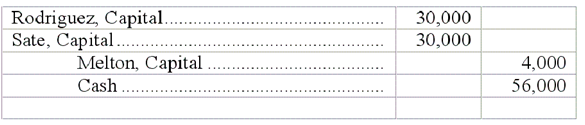

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The BlueFin Partnership agrees to dissolve. The

Q9: When partners invest in a partnership, their

Q34: A capital deficiency exists when all partners

Q37: Collins and Farina are forming a partnership.

Q47: A _ is an unincorporated association of

Q59: In closing the accounts at the end

Q68: Baldwin and Tanner formed a partnership.Baldwin's initial

Q78: The withdrawals account of each partner is:<br>A)

Q85: Sierra and Jenson formed a partnership. Sierra

Q92: A partnership agreement:<br>A) Is not binding unless