Multiple Choice

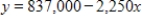

When a $837,000 building is depreciated for tax purposes (by the straight-line method) , its value y after x months of use is given by  . How many months will it be before the building is fully depreciated (that is, its value is $0) ?

. How many months will it be before the building is fully depreciated (that is, its value is $0) ?

A) 37 months

B) 372 months

C) 4 months

D) 27 months

E) 270 months

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Use the left-to-right elimination method to solve

Q39: Write the equation of the line through

Q40: Graph the equation with a graphing utility;

Q41: The number (in millions) of women in

Q43: If a line is vertical, then its

Q44: The relation defined by the table is

Q45: Approximate the zeros of the function below

Q46: Find the domain and range of the

Q47: Find the slope m and y-intercept b

Q150: A retired woman has $130,000 to invest.