Multiple Choice

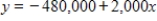

Suppose the cost of a business property is $480,000, and a company wants to use a straight-line depreciation schedule for a period of 240 months. If y is the value of this property after x months, then the company's depreciation schedule will be the equation of a line through (0,480000) and (240,0) . Write the equation of this depreciation schedule.

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q155: Solve the inequality. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Solve

Q156: Using a graphing utility or Excel to

Q157: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Solve

Q158: Which of the graphs below represent y

Q159: Solve the inequality. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Solve

Q161: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="If ,

Q162: Graph the equation with a standard window

Q163: Financial Paper, Inc. is a printer of

Q164: A concert promoter needs to make $42,000

Q165: The equation in this problem leads to