Multiple Choice

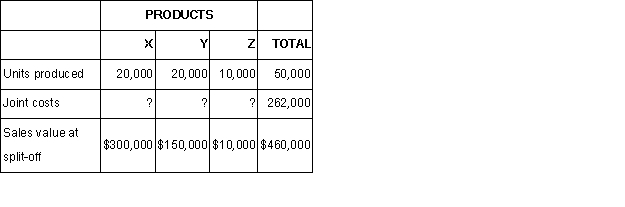

Bonanza Co.manufactures products X and Y from a joint process that also yields a by-product,Z.Revenue from sales of Z is treated as a reduction of joint costs.Additional information is as follows:  Joint costs were allocated using the net realizable value method at the split-off point.The joint costs allocated to product X were

Joint costs were allocated using the net realizable value method at the split-off point.The joint costs allocated to product X were

A) $75,000.

B) $100,800.

C) $150,000.

D) $168,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q78: Describe the difference between the direct method

Q103: Tenet Engineering,Inc.operates two user divisions as

Q104: The Mallak Company produced three joint

Q105: Cordner Corporation has two production Departments: P1

Q106: Cordner Corporation has two production Departments: P1

Q109: Joint products and by-products are produced simultaneously

Q110: Liberty Credit Checks produces two styles

Q111: Which of the following statements is true

Q112: The Marketplace Corporation produces two consumer

Q113: The following information relates to Osceola