Multiple Choice

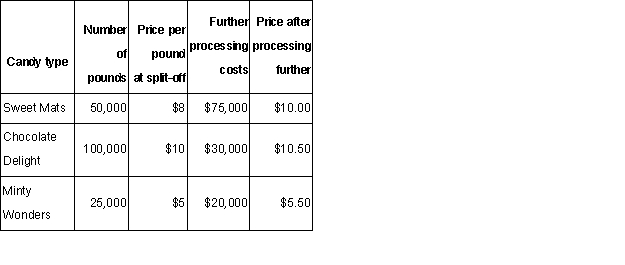

Delite Confectionary Company produces various types of candies.Several candies could be sold at the split-off point or processed further and sold in a different form after further processing.The candies are produced in a joint processing operation with $500,000 of joint processing costs monthly,which are allocated based on pounds produced.Information concerning this process for a recent month appears below: If Chocolate Delight is processed further,the gross profit margin that will appear in a product line income statement for Chocolate Delight would be:

If Chocolate Delight is processed further,the gross profit margin that will appear in a product line income statement for Chocolate Delight would be:

A) $734,286.

B) $520,000.

C) $1,020,000.

D) $632,596.

Correct Answer:

Verified

Correct Answer:

Verified

Q88: There are several methods for allocating service

Q89: Data Master is a computer software consulting

Q90: The following set up is a

Q91: The Mallak Company produced three joint

Q92: Delite Confectionary Company produces various types of

Q94: Products with a relatively minor sales value

Q95: A management purpose for allocating joint costs

Q96: Morgan and Regis Consultants is a

Q97: Advanced Computer Solutions,Inc.has two main services:

Q98: Jack Donaldson owns and operates Jack's