Multiple Choice

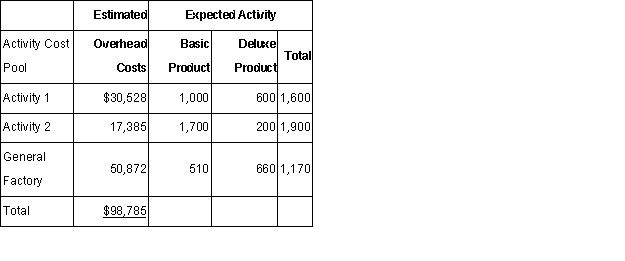

Markham Company makes two products: Basic Product and Deluxe Product.Annual production and sales are 1,700 units of Basic Product and 1,100 units of Deluxe Product.The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products.Basic Product requires 0.3 direct labor hours per unit and Deluxe Product requires 0.6 direct labor hours per unit.The total estimated overhead for next period is $98,785.The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports.The new activity-based costing system would have three overhead activity cost pools-Activity 1,Activity 2,and General Factory-with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor hours. )

The overhead cost per unit of Deluxe Product under the activity-based costing system is closest to:

A) $50.66.

B) $26.09.

C) $35.28.

D) $38.16.

Correct Answer:

Verified

Correct Answer:

Verified

Q116: Brenda's Big Burgers,a small hamburger restaurant and

Q117: Activity-based costing (ABC)can be applied to administrative

Q118: Before using activity-based costing (ABC),managers must apply

Q119: The Mega Construction Company recently switched

Q120: Upton Manufacturing Corporation has a traditional

Q122: Mission Company is preparing its annual

Q123: Work Horse Corporation uses the following

Q124: Allure Company manufactures and distributes two

Q126: The electricity used for production machinery would

Q136: Which of the following statements is true?<br>A)