Multiple Choice

Cassidy Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs) .The company has two products,VIP and Kommander,about which it has provided the following data:

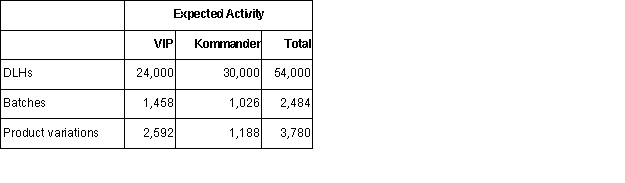

The company's estimated total manufacturing overhead for the year is $2,449,440 and the company's estimated total direct labor-hours for the year is 54,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The unit product cost of Product Kommander under the activity-based costing system is closest to:

A) $204.82.

B) $68.70.

C) $182.80.

D) $114.10.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Describe four classifications of cost drivers.

Q57: Which of the following should not be

Q72: The basic difference between a first-stage cost

Q94: How can activity-based systems help managers in

Q138: Installing activity-based costing requires teamwork among employees

Q140: Activity-based costing provides:<br>A) more detailed measures of

Q141: Would the following activities at a

Q143: Companies using activity-based costing (ABC)have learned that

Q144: The department cost allocation method provides more

Q145: Which of the following measures is used