Essay

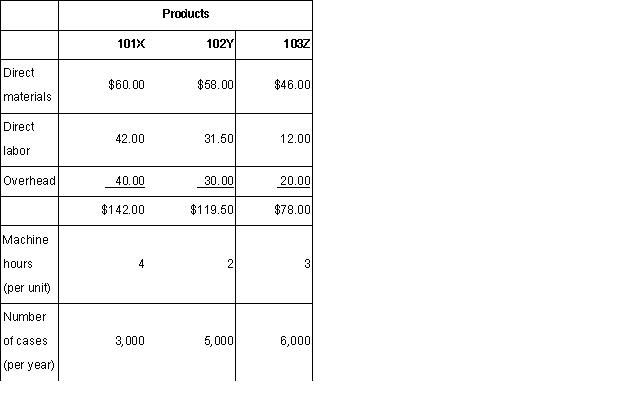

Blalock Company manufactures and distributes several different products.The company currently uses a plantwide allocation method for allocating overhead at a rate of $10 per direct labor hour.Department A produces Products #101X and #102Y.Department A has $262,000 in traceable overhead.Department B manufactures Product #103Z.Department B has $128,000 in traceable overhead.The product costs (per unit)and other information are as follows:

Required:

a.If Blalock changes its allocation basis to machine hours,what is the total product cost per unit for Product 101X,102Y,and 103Z?

b.If Blalock changes its overhead allocation to departmental rates,what are the product costs per unit for Product 101X,102Y,and 103Z,assuming Departments A and B use direct labor hours and machine hours as their respective allocation bases?

Correct Answer:

Verified

a.101X: $39.00;102Y: $19.50;103Z: $29.2...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: "Activity-based costing is just a more precise

Q6: Activity-based costing (ABC) is a costing technique

Q32: Mission Company is preparing its annual

Q34: The plantwide cost allocation method should be

Q35: In general,low-volume products (and services)have a lower

Q36: Banc Corp.Trust is considering either a

Q38: A cost hierarchy classifies cost drivers by

Q39: The plantwide allocation concept cannot be used

Q41: The number of services provided by an

Q42: Data concerning three of Parkeman Corporation's activity