Essay

Silverton Manufacturing Company builds highly sophisticated engine parts for cars competing in stock racing and drag racing.The company uses a normal costing system that applies factory overhead on the basis of direct labor-hours.For 2016,the company estimated that it would incur $256,000 in factory overhead costs and 16,000 direct labor-hours.The April 1,2016,balance in inventory accounts follow:

Job Y12 is the only job in process on April 1,2016.The following transactions were recorded for the month of April:

a.Purchased materials on account,$180,000.b.Issued $182,000 of materials to production,$8,000 of which was for indirect materials.Cost of direct materials issued:

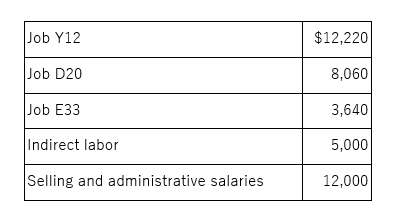

c.Incurred and paid payroll cost of $40,920;Direct labor cost ($20/hour;total 1,196 hours):

d.Recognized depreciation for the month:

Manufacturing asset $4,400

Selling and administrative asset 3,400

e.Paid advertising expenses $12,000.

f.Incurred factory utility costs 2,600.

g.Incurred other factory overhead costs 3,200.

h.Applied factory overhead to production on the basis of direct labor-hours.

i.Completed Job Y12 during the month and transferred it to the finished goods warehouse

.j.Sold Job Z11 on account for $118,000.

k.Received $50,000 of collections on account from customers during the month.

Required:

(1)Calculate the company's predetermined overhead rate.

(2)Prepare journal entries for the April transactions.Record job-specific items in individual Work-in-Process accounts.

(3)What was the balance of the Materials Inventory account on April 30,2016?

(4)What was the balance of the Work-in-Process Inventory control account on April 30?

Correct Answer:

Verified

1. Predetermined overhead rate: $16.00 p...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q114: The term "product" often refers to an

Q115: Which of the following statements is (are)true

Q116: The management of Marysville Corporation would like

Q118: For Case (A)above,what is the Beginning

Q120: The following information has been gathered

Q121: The Transfers In (TI)costs in the basic

Q123: For Case (B)above,what is the Ending

Q124: Moore Corporation bases its predetermined overhead rate

Q136: The basic cost flow model is:<br>A) EB

Q149: Trippett Industries manufactures cleaning products. During the