Multiple Choice

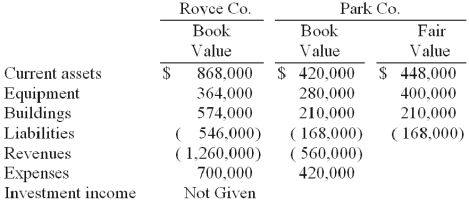

Royce Co. acquired 60% of Park Co. for $420,000 on December 31, 2010 when Park's book value was $560,000. The Royce stock was not actively traded. On the date of acquisition, Park had equipment (with a ten-year life) that was undervalued in the financial records by $140,000. One year later, the following selected figures were reported by the two companies. Additionally, no dividends have been paid.

-What is the consolidated balance of the Equipment account at December 31, 2011?

A) $644,400.

B) $784,000.

C) $719,600.

D) $770,000.

E) $775,600.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: McGuire company acquired 90 percent of

Q29: In comparing U.S. GAAP and international financial

Q29: Pell Company acquires 80% of Demers

Q33: Pell Company acquires 80% of Demers

Q34: Pell Company acquires 80% of Demers

Q35: Pell Company acquires 80% of Demers

Q37: On January 1, 2010, Palk Corp. and

Q46: Pell Company acquires 80% of Demers

Q69: When a parent uses the partial equity

Q108: Tosco Co. paid $540,000 for 80% of