Essay

On January 1, 2017, Larmer Corp. (a Canadian company) purchased 80% of Martin Inc, an American company, for US$50,000.

Martin's book values approximated its fair values on that date except for plant and equipment, which had a fair value of US$30,000 with a remaining life expectancy of 5 years. A goodwill impairment loss of US$1,000 occurred during 2017. Martin's January 1, 2017 Balance Sheet is shown below (in U.S. dollars): The following exchange rates were in effect during 2017:

Dividends declared and paid December 31, 2017.

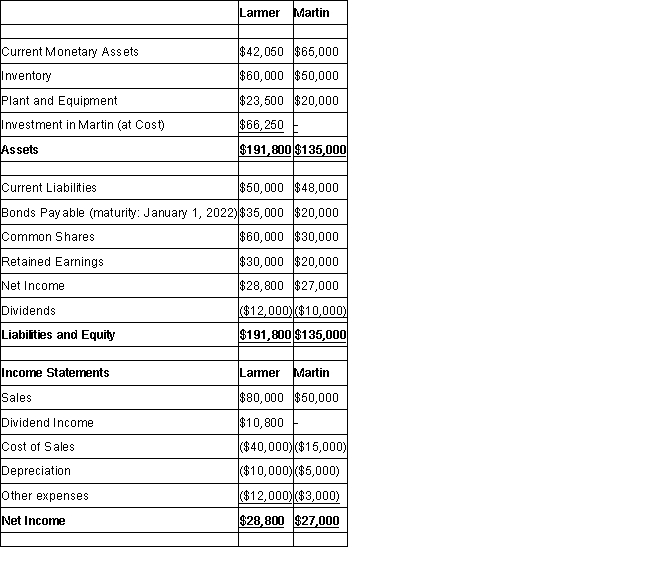

The financial statements of Larmer (in Canadian dollars) and Martin (in U.S. dollars) are shown below:

Balance Sheets

-Translate Martin's 2017 Income Statement into Canadian dollars if Martin is considered to be a self-sustaining foreign subsidiary (i.e., the functional currency of the foreign operation is different than the parent).

Correct Answer:

Verified

\[\begin{array} { | l | l | l | l | }

\...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

\...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Which of the following statements is correct?<br>A)

Q5: Which of the following rates would be

Q6: The risk exposure resulting from the translation

Q7: Compute Wilsen's exchange gain or loss for

Q8: Which of the following rates would be

Q10: Which of the following rates would be

Q11: The risk exposure resulting from the possible

Q12: Which of the following rates would be

Q13: Which of the following rates would be

Q14: If the functional currency of the foreign