Essay

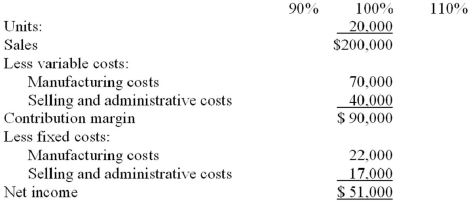

The Jordan Company, estimating its sales to be 20,000 units for the upcoming period, prepared the following static budget:

The owner of the business is not so sure about the 20,000 unit sales volume and has requested additional budgets.

Required:

In the table provided, prepare two additional budgets, one at 90% of the static budget volume level and one at 110% of the static budget volume level.

Flexible budgets at 90% and 110%:

Correct Answer:

Verified

Correct Answer:

Verified

Q82: If the master budget prepared at a

Q83: Which of the following software applications is

Q84: Which of the following income statement formats

Q85: If Paterno Company's turnover measure is 2.5

Q86: Based on the information given for

Q88: Caroline Farr is manager of a

Q89: Evaluation of the amount of costs incurred

Q90: Which of the following statements about ROI

Q91: The following static budget is provided: <img

Q92: Use the following information to answer