Essay

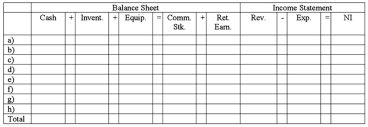

The Szakos Company engaged in the following transactions during 2013:

a) Acquired $50,000 of cash by issuing common stock to owners

b) Paid $10,000 to acquire manufacturing equipment

c) Paid $5,000 cash for materials used in production

d) Paid $2,000 for wages of production workers

e) Paid $8,000 in general, selling, and administrative costs

f) Recognized $1,000 of depreciation on the manufacturing equipment

g) Sold inventory for $18,000 cash

h) The cost of the inventory sold was $6,500

Required:

Show the balance sheet and income statement effects of the transactions by completing the financial statement model provided.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following is not classified

Q21: Costs that are not classified as product

Q53: Complete the following table to compare

Q56: Steuben Company produces dog houses. During

Q60: If product costs are misclassified as selling

Q86: For a manufacturing company,both direct labor costs

Q97: The primary difference between manufacturing companies and

Q103: How does the level of aggregation differ

Q120: Management accountants have a responsibility to be

Q123: A company that uses a just-in-time inventory