Essay

The following information is available for Parsons Corporation, which uses the allowance method of accounting for uncollectible accounts.

Parsons expects 1% of sales on account to be uncollectible.

Required:

a) What is the balance of Accounts Receivable at the end of 2014?

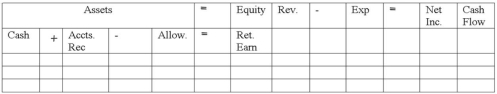

b) What is the amount of uncollectible accounts expense for 2014? Use the financial statements model below to indicate the effect of recording uncollectible accounts expense. Include dollar amounts of increases and decreases.

c) In 2015, after several attempts of collection, Parsons wrote off accounts that could not be collected in the amount of $300. Use the financial statements model that is provided to indicate the effect of the write-off on the financial statements, indicating amounts of increases and decreases.

d) Later in 2015, Erin received a check for $50 from one of the customers whose account had been written off in (c) above. Use the financial statements model to indicate the effect of the collection of the $50 on the financial statements, indicating amounts of increases and decreases.

Correct Answer:

Verified

a) Balance in accounts receiva...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: If Schulze Company is using LIFO, how

Q103: Which of the following is not an

Q104: Indicate how each event affects the

Q105: On June 1, 2014, Siebens Enterprises loaned

Q106: Loaning money to another company through a

Q108: Delta Company was accruing interest on a

Q109: The person responsible for making payment on

Q110: Matsuzaka Company uses the allowance method to

Q111: On January 1, 2014 the Accounts Receivable

Q112: On June 1, 2014, Siebens Enterprises loaned