Essay

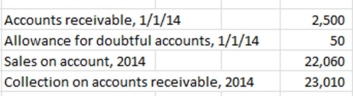

The following information is available for K.M.R. Company, which uses the allowance method of accounting for uncollectible accounts.

K.M.R. estimates that 1% of sales on account will be uncollectible. After several attempts at collection during 2014, K.M.R. wrote off an account of $200 that could not be collected.

Required:

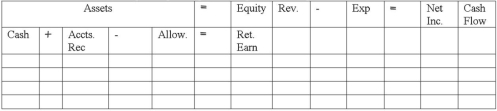

Indicate the effects on the financial statements of the following events:

a) 2014 sales

b) 2014 collections on account

c) Write-off of the uncollectible account

d) Uncollectible accounts expense for 2014

Round amounts to nearest dollar. Show amounts of increases and decreases. For cash flows, indicate whether they are operating, investing, or financing activities.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The adjusting entry to recognize uncollectible accounts

Q8: The adjusting entry to recognize uncollectible accounts

Q82: Bruner Company uses the percent of receivables

Q83: Indicate how each event affects the

Q84: In an inflationary period, which inventory cost

Q85: The net realizable value of accounts receivable

Q87: After the accounts are adjusted at the

Q88: On January 1, 2014 the Accounts Receivable

Q90: Indicate how each event affects the

Q91: Howard Company accepts a credit card as