Essay

The transactions listed below apply to Lovell Company for its first year in business. Assume that all transactions involve the receipt or payment of cash.

Transactions for the year 2012:

1) Issued common stock to investors for $15,000 cash.

2) Borrowed $8,000 from the local bank.

3) Provided services to customers for $18,000.

4) Paid expenses amounting to $11,400.

5) Purchased a plot of land costing $12,000.

6) Paid a dividend of $6,000 to its stockholders.

7) Repaid $4,000 of the loan listed in item 2.

Required:

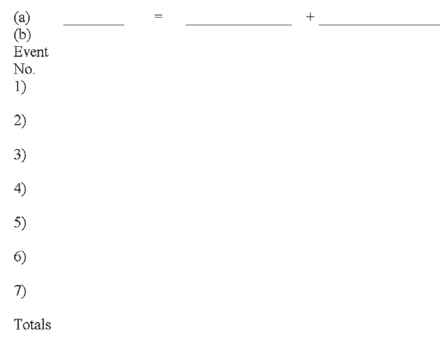

(a) Fill in the headings to the accounting equation shown below.

(b) Show the effects of the above transactions on the accounting equation.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Stinespring Company was founded in 2012. It

Q22: Petras Company engaged in the following transactions

Q23: An asset source transaction increases a business's

Q23: What does a company's statement of cash

Q102: Indicate whether each of the following statements

Q104: Explain some of the accounting similarities and

Q137: Indicate whether each of the following statements

Q139: Who are the three distinct types of

Q147: The Ruiz Company began operations on January

Q222: Yang Company reported the following balance sheet