Essay

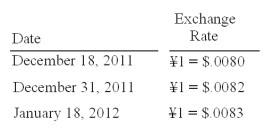

Gaw Produce Co. purchased inventory from a Japanese company on December 18, 2011. Payment of 4,000,000 yen ( ) was due on January 18, 2012. Exchange rates between the dollar and the yen were as follows:

Required:

Prepare all journal entries for Gaw Produce Co. in connection with the purchase and payment.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: A U.S. company sells merchandise to a

Q23: What amount of foreign exchange gain or

Q24: Car Corp. (a U.S.-based company) sold

Q31: Meisner Co.ordered parts costing §100,000 for a

Q37: Lawrence Company, a U.S.company, ordered parts costing

Q39: All of the following hedges are used

Q46: What amount of foreign exchange gain or

Q72: What factors create a foreign exchange gain?

Q80: What happens when a U.S. company sells

Q90: Belsen purchased inventory on December 1, 2010.