Multiple Choice

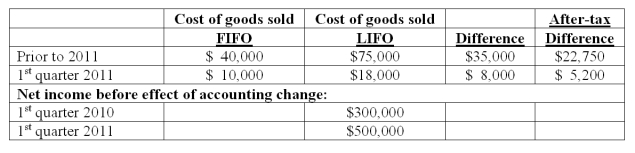

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2011, how much is reported as net income for the first quarter of 2011?

A) $492,000.

B) $494,800.

C) $500,000.

D) $505,200.

E) $527,950.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: What is the appropriate treatment in an

Q56: Peterson Corporation has three operating segments with

Q58: Faru Co. identified five industry segments:

Q59: Whitley Corporation identified four operating segments:

Q63: The following information for Urbanski Corporation relates

Q64: Kurves Corp. had six different operating

Q74: Which of the following must be disclosed

Q80: Which of the following is not correct

Q85: Which operating segments are reportable under the

Q94: List the five aggregation criteria that need