Essay

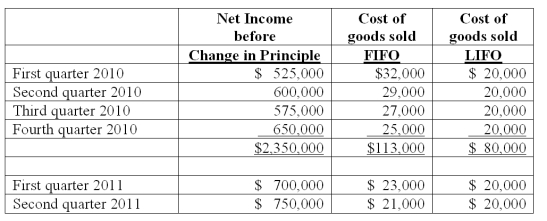

Harrison Company, Inc. began operations on January 1, 2010, and applied the LIFO method for inventory valuation. On June 10, 2011, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:  The LIFO method was applied during the first quarter of 2011 and the FIFO method was applied during the second quarter of 2011 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

The LIFO method was applied during the first quarter of 2011 and the FIFO method was applied during the second quarter of 2011 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

-Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30, 2010 and 2011.

Correct Answer:

Verified

Net Income and Earni...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: The amount of gross profit for the

Q47: Which of the following items of information

Q64: Kurves Corp. had six different operating

Q70: The hardware operating segment of Bloom Corporation

Q71: What is the minimum amount of assets

Q74: Which of the following must be disclosed

Q74: Provo, Inc. has an estimated annual tax

Q75: Which of the following costs require similar

Q79: Which operating segments are reportable under the

Q107: Which items of information are required to