Multiple Choice

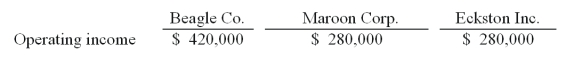

Beagle Co. owned 80% of Maroon Corp. Maroon owned 90% of Eckston Inc. Operating income totals for 2011 are shown below; these figures contained no investment income. Amortization expense was not required by any of these acquisitions. Included in Eckston's operating income was a $56,000 unrealized gain on intra-entity transfers to Maroon.

-The accrual-based income of Beagle Co. is calculated to be

A) $706,670.

B) $755,980.

C) $805,280.

D) $838,150.

E) $815,770.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Woods Company has one depreciable asset valued

Q60: C Co. currently owns 80% of D

Q67: Which of the following statements is true

Q71: X Co. owned 80% of Y Corp.,

Q72: Tower Company owns 85% of Hill Company.

Q73: Alpha Corporation owns 100 percent of Beta

Q75: Hardford Corp. held 80% of Inglestone Inc.

Q76: For West Corp. and consolidated subsidiaries, what

Q77: How much will the consolidated group save

Q79: River Co. owned 80% of Boat Inc.