Multiple Choice

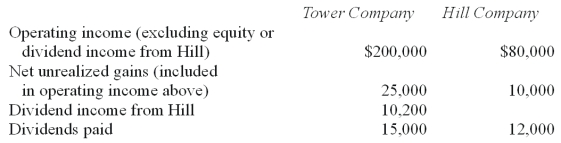

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. Each company's operating and dividend income for the current time period follow, as well as the effects of unrealized gains. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.

-Under the separate return method, how much income tax expense will be assigned to Hill?

A) $24,000.

B) $22,857.

C) $24,874.

D) $21,874.

E) $21,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Kurton Inc. owned 90% of Luvyn Corp.'s

Q13: West Corp. owned 70% of the voting

Q14: Delta Corporation owns 90 percent of Sigma

Q16: On January 1, 2010, Mace Co. acquired

Q18: Chase Company owns 80% of Lawrence Company

Q20: Delta Corporation owns 90 percent of Sigma

Q22: On January 1, 2010, Jones Company bought

Q30: What is consolidated net income?<br>A) $229,500.<br>B) $237,000.<br>C)

Q54: Wilkins Inc. owned 60% of Motumbo Co.

Q109: Required:<br>Prepare a schedule to show consolidated net