Essay

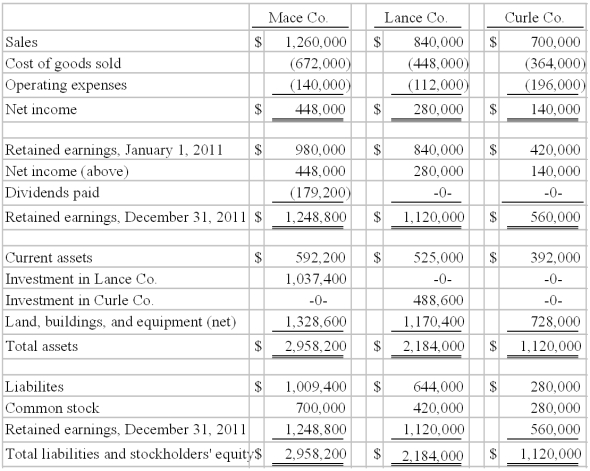

On January 1, 2010, Mace Co. acquired 75% of Lance Co.'s outstanding common stock. On the same date, Lance acquired an 80% interest in Curle Co. Both of these investments were acquired when book value was equal to fair value of identifiable net assets acquired. Both of these investments were accounted using the initial value method. No dividends were distributed by either Lance or Curle during 2010 or 2011. Mace paid cash dividends each year equal to 40% of operating income. Reported operating income totals for 2010 were as follows:  Following are the 2011 financial statements for these three companies. Curle made numerous transfers of inventory to Lance since the takeover: $112,000 (2010) and $140,000 (2011). These transactions included the same markup applicable to Curle's outside sales. In each of these years, Lance carried 20% of this inventory into the succeeding year before disposing of it.

Following are the 2011 financial statements for these three companies. Curle made numerous transfers of inventory to Lance since the takeover: $112,000 (2010) and $140,000 (2011). These transactions included the same markup applicable to Curle's outside sales. In each of these years, Lance carried 20% of this inventory into the succeeding year before disposing of it.

An effective income tax rate of 45% was applicable to all companies.

-Required:

Determine the noncontrolling interest in Curle Co.'s net income for the year 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Horse Corporation acquires all of Pony, Inc.for

Q14: Pear, Inc. owns 80 percent of Apple

Q24: Strong Company has had poor operating results

Q86: Dog Corporation acquires all of Cat, Inc.for

Q106: Jull Corp. owned 80% of Solaver Co.

Q107: Alpha Corporation owns 100 percent of Beta

Q110: On January 1, 2010, Mace Co. acquired

Q112: Chase Company owns 80% of Lawrence Company

Q114: Delta Corporation owns 90 percent of Sigma

Q115: For each of the following situations, select