Essay

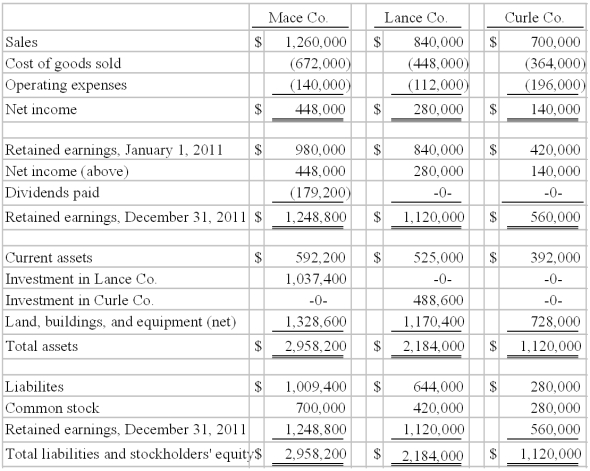

On January 1, 2010, Mace Co. acquired 75% of Lance Co.'s outstanding common stock. On the same date, Lance acquired an 80% interest in Curle Co. Both of these investments were acquired when book value was equal to fair value of identifiable net assets acquired. Both of these investments were accounted using the initial value method. No dividends were distributed by either Lance or Curle during 2010 or 2011. Mace paid cash dividends each year equal to 40% of operating income. Reported operating income totals for 2010 were as follows:  Following are the 2011 financial statements for these three companies. Curle made numerous transfers of inventory to Lance since the takeover: $112,000 (2010) and $140,000 (2011). These transactions included the same markup applicable to Curle's outside sales. In each of these years, Lance carried 20% of this inventory into the succeeding year before disposing of it.

Following are the 2011 financial statements for these three companies. Curle made numerous transfers of inventory to Lance since the takeover: $112,000 (2010) and $140,000 (2011). These transactions included the same markup applicable to Curle's outside sales. In each of these years, Lance carried 20% of this inventory into the succeeding year before disposing of it.

An effective income tax rate of 45% was applicable to all companies.

-Required:

Determine the accrual-based income of Mace Co for the year 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Alpha Corporation owns 100 percent of Beta

Q5: What amount of dividends did West Corp.

Q8: West Corp. owned 70% of the voting

Q10: On January 1, 2010, Jones Company bought

Q11: Alpha Corporation owns 100 percent of Beta

Q19: Evanston Co. owned 60% of Montgomery Corp.

Q21: How is goodwill amortized?<br>A) It is not

Q39: What ownership structure is referred to as

Q55: What method is used in consolidation to

Q86: Which of the following statements is true